franklin county ohio sales tax rate 2020

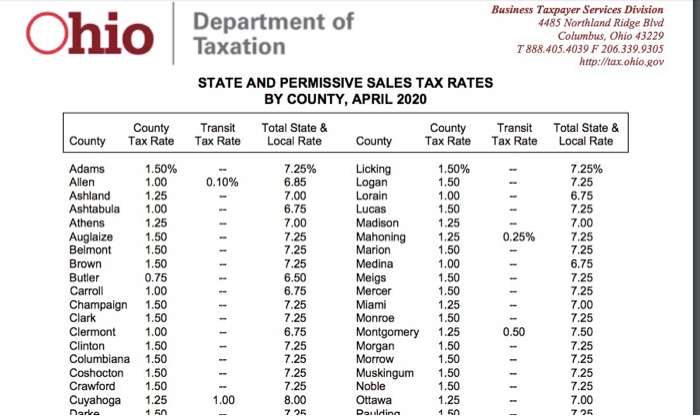

The sales tax jurisdiction. Franklin 125 050 750 Putnam 125 700 Fulton 150 725 Richland 125 700 Gallia 150 725 Ross 150 725.

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

You can print a 7 sales tax table here.

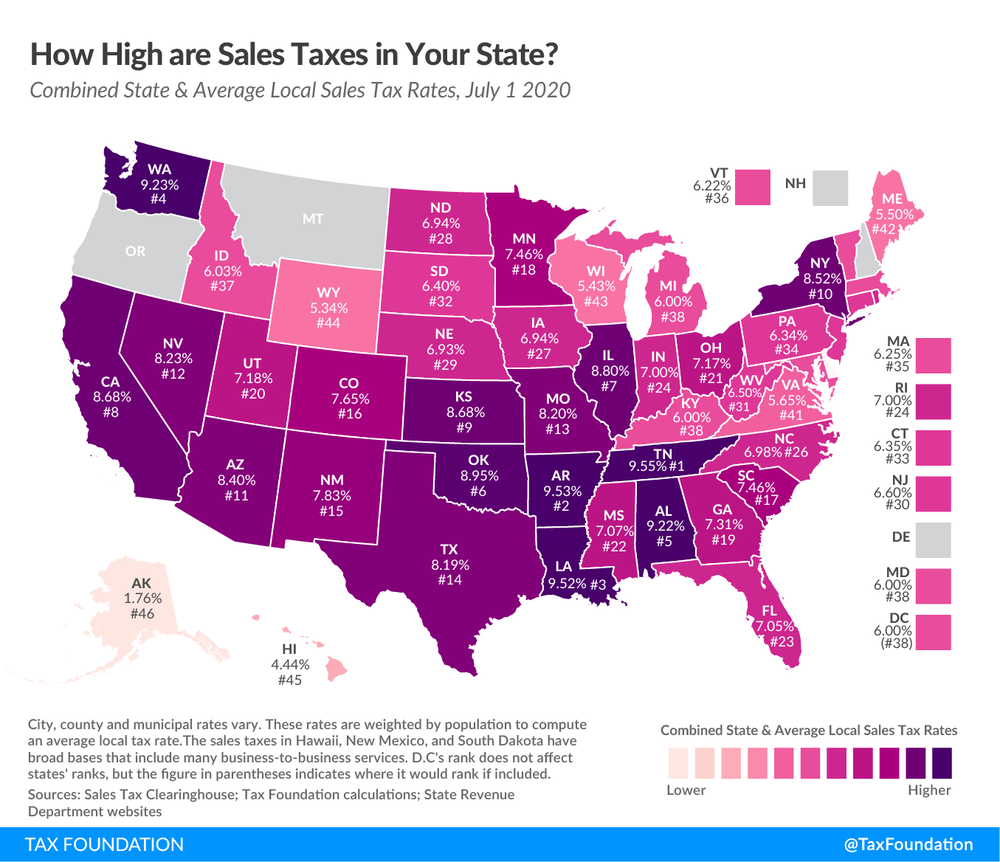

. The December 2020 total local sales tax rate was also 7000. The Franklin County Sales Tax is 125. Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225.

There is no applicable city tax. 2nd Quarter effective April 1 2020 - June 30 2020 Rates listed by county and transit authority. What is Ohio sales tax rate 2020.

What is Ohio sales tax rate 2020. By emailing the Franklin County Treasurers Office you may obtain an email listing of properties included in the tax lien certificate sale. The current total local sales tax rate in Franklin County OH is 7500.

There is no applicable city tax or special tax. Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the.

How much is sales tax on a. Such public record requests may be directed to. Sales tax in Franklin County Ohio is currently 75.

STATE OF OHIO. Postmark does not apply Gross Real Estate Taxes for 2021 Tax Reduction. This is the total of state and county sales tax rates.

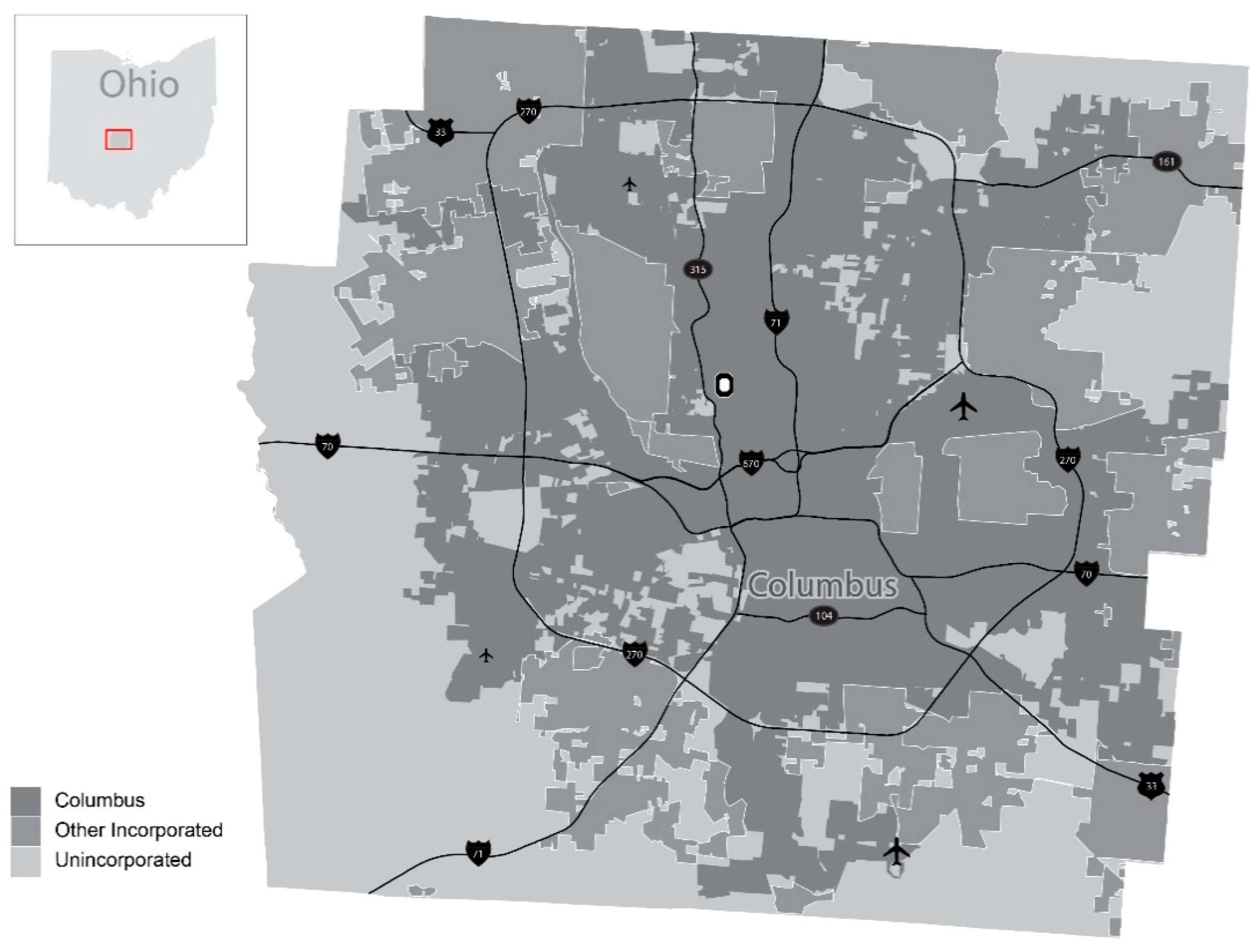

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. Franklin County Treasurer 373 South High Street 17th Floor Columbus OH 43215-6306. There were no sales and use tax county rate changes effective July 1 2020.

The December 2020 total local sales tax rate was also 7500. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the Franklin. Average Sales Tax With Local.

A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. Some cities and local. How much is sales tax on a.

DEPARTMENT OF TAXATION. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. With local taxes the total sales tax rate is between 6500 and 8000.

What is the sales tax rate in Franklin County. The state sales tax rate in Ohio is 5750. The December 2020 total local sales tax rate was also 7250.

The following list of Ohio post offices shows the total county. The minimum combined 2022 sales tax rate for Franklin County Ohio is. PAGE 1 REVISED October 1 2020.

The current total local sales tax rate in Franklin Furnace OH is 7250. COLUMBUS OH 43216-0530. The state sales tax rate in Ohio is 5750.

With local taxes the total sales tax rate is between 6500 and 8000. Franklin OH Sales Tax Rate The current total local sales tax rate in Franklin OH is 7000. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the.

If you need access to a database of all Ohio local sales tax.

Franklin County Unlikely To Raise Taxes Despite Covid Revenue Drop

Greater Dayton Communities Tax Comparison Information

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ijerph Free Full Text Neighborhood Level Lead Paint Hazard For Children Under 6 A Tool For Proactive And Equitable Intervention Html

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

Finance Worthington Oh Official Website

Ohio Taxes Apps On Google Play

Franklin County Ohio Ballot Measures Ballotpedia

Ohio Tax Rates Things To Know Credit Karma

Local Income Taxes In 2019 Local Income Tax City County Level

Sales Taxes In The United States Wikipedia

![]()

Harley Rouda S Companies Racked Up Hundreds Of Thousands In Tax Liens

School District Income Tax Department Of Taxation

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

Ohio Sales Tax Calculator Reverse Sales Dremployee

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions